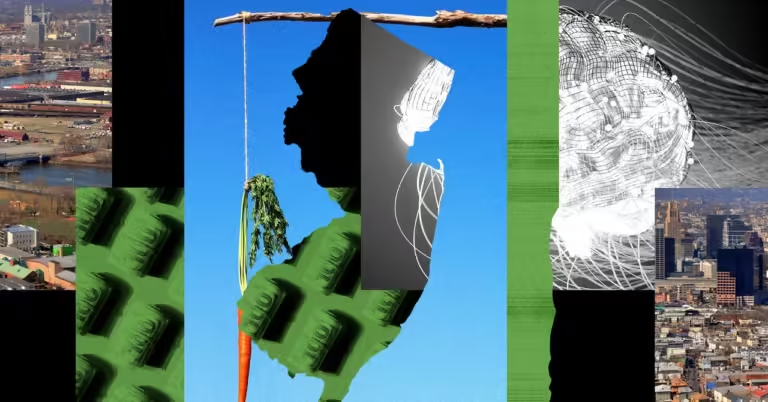

New Jersey is making new plans to become a U.S. hub for AI innovation, with the governor signing a bill Thursday that will provide up to $500 million in tax credits to artificial intelligence companies based in the state.

“I want New Jerseyans to be at the forefront of the AI revolution and build a richer world in the process,” New Jersey Governor Phil Murphy (D) said in a statement. “In doing so, we intend to establish New Jersey as a hub for generative AI research and development.”

AI companies with significant operations in New Jersey, as well as the data centers that support AI, may be eligible for the tax credit, which repurposes unused funds from two other state tax credit programs for job creation and real estate development enacted in response to the COVID-19 pandemic.

Critics of the plan worry that while it may be a gain for profitable AI companies, it could be a loss for the state. Data centers typically require few employees, and tax incentives in general (including those given to tech companies) could end up costing the state more than the benefits. In an analysis of the bill, the New Jersey Department of Legislative Services, a bipartisan advocacy agency for the New Jersey Legislature, said it “cannot determine whether this bill would have a positive or negative net fiscal impact to the state.”

The tax credit is in line with Murphy’s “AI Moonshot” initiative for New Jersey, announced earlier this year, in which he said the state’s actions would “establish New Jersey as a home for AI-powered game changers.”

CoreWeave, a cloud provider for AI out of New Jersey, recently raised $1.1 billion at a valuation of $19 billion. And the state could expand its market by capitalizing on growing demand for data centers in the New York area. A report from commercial real estate firm CBRE found that rental vacancy rates fell from 9.7% to 6.5% from the beginning to the second half of 2023. The report also noted that AI companies are pre-leasing space in East Windsor, a New Jersey town between New York and Philadelphia.

AI businesses are driving a surge in venture capital funding. These highly profitable companies need data centers to do business, and they’ll put them somewhere. And they don’t need incentives to do so. “This is a growing, very healthy industry that needs public support to do business,” said Kasia Tarczynska, senior research analyst at Good Jobs First, a U.S. national policy resource center that promotes corporate and government accountability in economic development.

Companies working on data centers and AI often qualify for general business tax breaks in the U.S. But those data center tax credits “are not particularly strategic,” says Tim Sullivan, CEO of the New Jersey Economic Development Authority.

New Jersey’s plan is different from other states, he argues, because companies that benefit from the tax credits would also need to secure computing power at discounts or provide AI support to small businesses and universities. While real estate in New Jersey isn’t cheap (it has the highest corporate tax rate in the U.S.), proximity to populated areas is very valuable for data centers. Opening sites closer to businesses reduces latency.